Revathi

Ideas to take away from this lesson

- Money originated to overcome the difficulties of the barter system.

- Money is an innovation that significantly improved the operation of the markets.

- Banks facilitate the operation of the markets by expanding the quantity of money in circulation.

- Inflation is a consequence of money supply growing faster than the production of goods.

- Inflation creates disruptions and losses in the overall economy as buyers and sellers act to avoid its effects.

Money – meaning

Money is that which is commonly used and generally acceptable as a ‘medium of exchange’ and a “standard of value”.

- Money makes it easier to trade, borrow, save, invest, and compare the value of goods and services.

- Money is anything that is widely accepted as the final payment for goods and services.

- Money encourages specialization by reducing the cost of exchange.

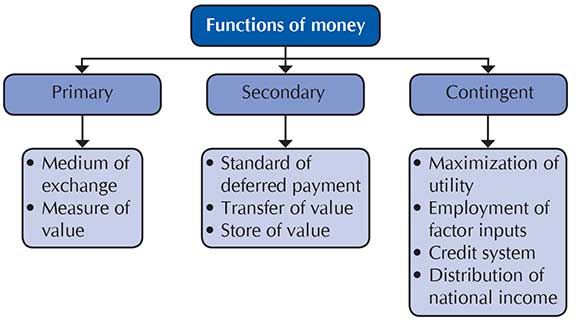

- Medium of exchange: Money makes transactions easier to conduct. So, in the absence of money, we might have to barter for goods and services – explain.

- Measure of value: Money is accepted as a common measure of value. Under the barter system, the value of a commodity was expressed in terms of another commodity – explain.

- Standard of deferred payment: Payments to be made in future can be expressed in terms of money because

– Its value is relatively more stable

– Durability is higher

– There is a quality of general acceptability – explain - Transfer of value: Value can be transferred from one person to another with the help of money – explain.

- Store of value: You can take the cash out of your wallet, put it in your cupboard draw, leave it there for two or three years. When you pull it out again, it has the same value minus the inflation. If you deposit it in a bank, it earns interest. But if you store commodities, they might not – explain.

Need to control the supply of money

Money represents purchasing power. If there is too much money in the economy, people will have too much purchasing power at their disposal. They will demand more goods and services. If adequate amount of goods and services are not available in the market, the prices of these goods and services will go up. The economy will get caught in what is known as inflation.

Inflation

• Increase in most prices

• Decrease in the value of money

• Decrease in purchasing power

When people’s income increases more slowly than the rate of inflation, their purchasing power declines.

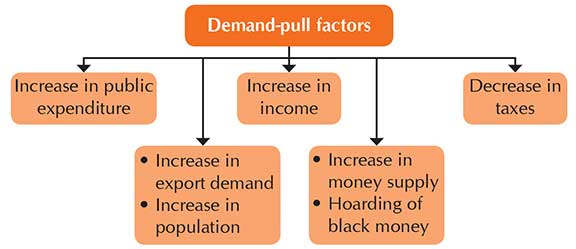

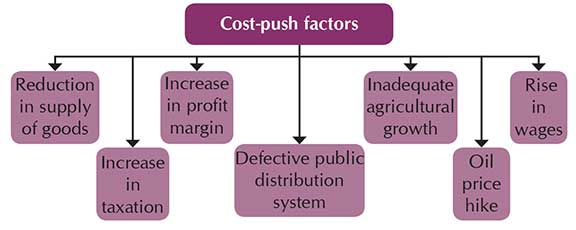

Inflation is a monetary phenomenon and almost always occurs because the increase in the stock of money exceeds the growth in output of goods and services. Inflation encourages more debt and faster spending. It creates uncertainty and makes future planning more difficult. Inflation may be caused by the ‘demand-pull’ factors, or ‘cost-push’ factors, or both working together.

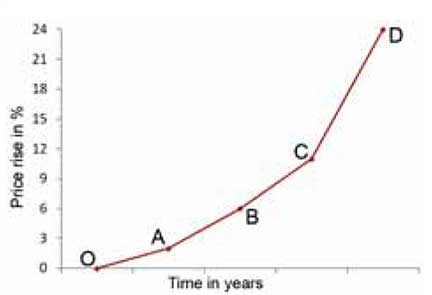

Inflation is always cumulative in the sense that a mild inflation in the first instance gathers momentum leading to a rapid rise in prices. Its effects on an economy depends on how rapid it is.

(iii) Domestic factors

Hoarding, less developed financial market in the developing nations

(iv) External factors

As the prices rise in USA, India imports commodities at a higher price leading to import inflation.

Effects of inflation

- Encourages speculation

- Lack of quality control

- Working class, fixed income group are affected

- Debtors gain, creditors are affected

- Reduction in savings

- Adverse balance of payments

- Lack of confidence in the currency

- Social and moral degradation

Types of inflation

- War-time inflation: It takes place during a war like situation when scarce productive resources are all diverted to produce military goods and equipment.

Post-war inflation: After the war, government controls are relaxed resulting in faster hike in prices. - Open inflation: The government does not attempt to restrict inflation.

Supressed inflation: When the government prevents price rise through price control, rationing, etc. - Demand-pull inflation: Due to the demand-pull factors.

Cost-push inflation: Due to the cost-push factors. - Creeping inflation: 2 to 3 percent rise in price level, mild inflation and it is not a problem.

Walking inflation: 3 to 6 percent rise in price level.

Running inflation: Rise in prices is over 8 percent. It is a warning signal indicating the need to control it.

Galloping inflation: 20 to 30 percent increase in price level. There is complete collapse of currency and economic and political life is disrupted.

The above mentioned information can be explained with the help of the following graph.

OA – Creeping inflation

AB – walking inflation

BC – running inflation

CD – galloping inflation

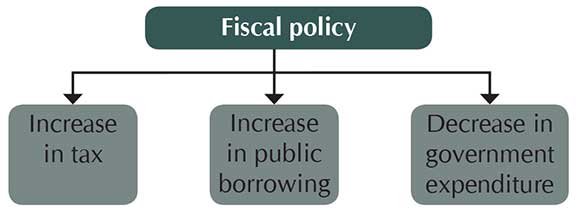

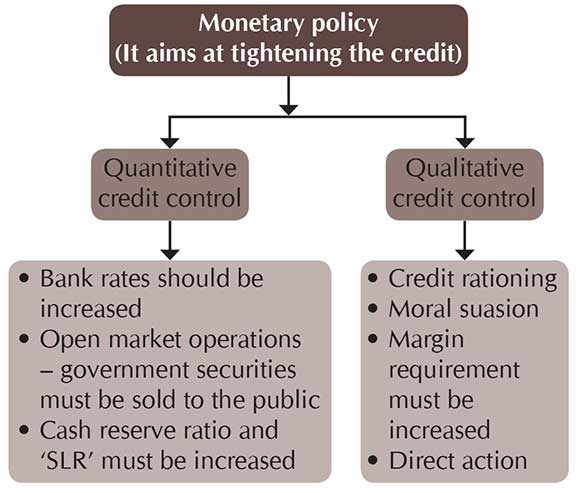

How can we control inflation?

(iii) Supply management: To correct excess demand relative to aggregate supply, the latter can be raised by importing goods that are in short supply. In India, to check the rise in prices of food grains, edible oil, sugar etc., the government has often taken steps to increase the import of goods in short supply to enlarge their available supplies.

(iv) Income policy – Freezing wages: Another anti inflationary measure which has often been suggested is avoidance of wage increases which are unrelated to improvements in productivity. Inflation often gets momentum through wage – price inflation.

Why does the government increase the money supply? To reduce the budget deficit. So, to reduce inflation, budget deficit must be avoided. The government should aim at a surplus budget.

The author is a teacher of history and economics at The Future Kid’s School, Hyderabad.