Suparna Roy

Terms like inventory control, expenditure budget, vendor management, financial plan are management jargons that may sound complicated and technical for a student who has not studied business or economics.

However, as we unpack these terms, we realize that all the functions they refer to are performed in a microscopic way right in our homes. Earlier, home making was the sole responsibility of women but now with increasing gender parity, the responsibility is in many cases shared by all members of the family.

In my childhood, I used to see my mother meticulously prepare the list of necessary items for the kitchen. She knew exactly how much and when the different items on the list needed to be purchased so that we had sufficient provisions for the month. The storage area and containers were designed to retain freshness of the supplies avoiding spoilage or contamination. Negotiating with vendors for a win-win deal, motivating domestic staff with small incentives were done in such a way that every penny spent brought optimum benefit to the family. The grocery list often became the base for the expenditure budget for the following month.

The quantum of finance required and how much to save and invest was decided by my father. He would encourage me to write a cheque, count money and also make me deposit some money in my bank account. In those days the bank had started a scheme for kids to encourage thrift. Rash buying for instant gratification rarely happened. A lot of research was always done before purchasing any asset for domestic use.

All documents were neatly filed and kept in a proper place for future reference. I used to accompany my father to his factory site and watch him decide the layout of the machines. He would explain the production process of peppermint flakes and crystals from menthol (pudina) oil. He used to ask me to sit with our accountant and prepare accounting vouchers. He would constantly tell me how important it was to pay off suppliers and creditors to maintain financial credibility in the market.

We can call this experiential and interdisciplinary learning which helped me develop an interest for business and finance as I grew up. Now I use all these experiences when I give examples to my students while teaching. I take my students for visits to factories, corporate offices and interact with the executives of various departments so that they can interact and imbibe practical knowledge. They are also encouraged to interview their parents about their business or profession as this results in long-term immersive learning.

Economics and accounting comprise all that I have been discussing above. However, the values that we have grown up with and the values imbibed by the millennial kids are radically different.

In this era of Internet, all processes are digitized. Technology has become our lifeblood and is no longer a choice. We have to learn how to transact online. E-commerce companies like Urban Company, Myntra, Swiggy, Ola, Uber, Olx, Paytm are household names now.

It is sad that the digitally smart generation is not ‘money smart’. We prefer to depend on financial advisors when it comes to handling personal finance. Many of us have still not realized that we are heading for difficult times as bank interest rates are plummeting. We need to save and invest as we have to keep pace with inflation.

Magic of compounding

| Number of years/Rate | 5% | 10% | 15% | 20% |

| 1 | 105 | 110 | 115 | 120 |

| 5 | 128 | 161 | 201 | 249 |

| 10 | 163 | 259 | 405 | 619 |

| 15 | 208 | 418 | 814 | 1541 |

| 20 | 339 | 1083 | 3292 | 9540 |

This schedule comes from a book published by NISM (National Institute of Securities Market) in collaboration with SEBI (Securities Exchange Board of India) to promote financial literacy among students.

This shows how a small amount of money can grow if invested properly.

Money mindedness is often misinterpreted as greed for money. Many of us think that money is a dirty word and quality time should be spent in discussing art, literature and the finer things of life, rather than money. We should be reminded of the umpteen promising careers gone awry because people did not save the money they earned when there was still time. They did not manage their savings well. They did not secure their future. Money teaches us to be prudent, money gives us a foresight to look into the future. As teachers we should encourage our students to manage or mind their money.

Money has four functions as we all know

A medium

A measure

A standard and

A store

This simple rhyme can be understood by all. Along with this we can also keep in mind the holy trinity of investment –

Safety Liquidity Growth

Scams, Ponzi schemes, debt burden are snares into which people very often step. We must start thinking about how to protect young from these traps and inculcate prudent financial behaviour in them. Whatever students learn at home or school has a long-term impact and will inspire them to lead a financially disciplined life. The short film “One Idiot” by Amole Gupte and IDFC Foundation (https://www.youtube.com/watch?v=vU1l1TB7GzI&t=29s) which speaks of similar values. The film features a character ‘Bugs uncle’ who leads a frugal life and encourages the youngsters living in his housing complex to save and invest. The film is quite dramatic and funny, and has a strong message.

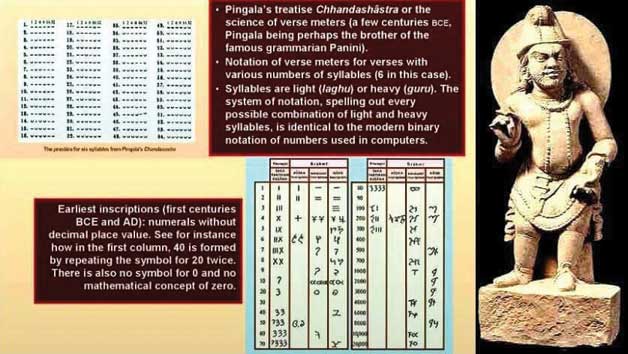

Many of us feel that investing in the stock market is almost like gambling where “fear and greed” seem to be the guiding factor. It is amazing to know that the price movements in a stock exchange follow a particular pattern as observed by specialists. The pattern can be explained with the Fibonacci series. Our mind keeps looking for patterns around us, in stars, shells, flowers, waves … even in paintings. Unknowingly, financial behaviour also follows this unique pattern. The Fibonacci series was first discovered by Leonardo Fibonacci a few years before the Italian renaissance. He had learned it from the Indian scholar Pingala who had used this series while writing some verses in Sanskrit. Pingala called this logic Chandashashtra. The Fibonacci series can be an excellent topic for project work.

We as teachers can guide our students in a trans-disciplinary way and develop a fantastic connect between science, maths, art, history, literature and finance with Fibonacci series.

This pandemic has taught us many new skills. Some old values and skills have resurfaced. It has brought about a paradigm shift in every aspect of our environment. Technology has become the base for survival of art, science and business. Resources should be used optimally not only in our homes, but also in the country and the world at large. The value of thrift and the prudence of wise, well-calculated investments are values that commerce teachers have to inculcate in students. This will mean going against the tide of the all consuming consumption. We must not forget that schools and other learning environments are like oases where alternatives can be practised and alternatives should be encouraged. Thrift is one such alternative that students can sow today and reap benefits tomorrow.

Our students are the human resource we are developing for tomorrow. Whatever we teach must have a connect with real life and also bring about some skill and value enhancement.

While introducing accountancy, I always tell my students how 500 years ago an Italian monk and mathematician, Luca Pacioli collaborated with the famous painter Leonardo DaVinci to write the book ‘Divine Proportions’. He also documented the principles of accounting for the first time in this book on account of which he is considered as the Father of the Double Entry system. This is another instance of collaborative work which took place during the Italian renaissance. I try to inspire my students to do research as to how accounting was practiced in India in the early ages and then compare that with the present. Swamped by information from the Net, students might enjoy independently discovering facts which relate to their textbook content.

It is another renaissance that we are living in. This pandemic has suddenly made us stop, think and reflect and reorient ourselves as learners and educational facilitators.

The author is the Head examiner of Accountancy with CBSE. As a Commerce teacher in Mahadevi Birla World Academy, for the last 27 years she has been experimenting various methods to make learning interesting, joyful and student-centric. She can be reached at suparnaroy1212@gmail.com.